Focus on equity investments of typically EUR 3 m to EUR 30 m in small & mid-sized businesses in the DACH-region combined with the experience of more than 100 transactions.

Investments

Ownership successions, corporate spin-offs, changes in the shareholder structure, special situations with increased complexity including (very selectively) underperformance situations, and growth financing

Growth

Strong focus on worldwide growth potential and buy&build opportunities (markets with consolidation potential). We support building defensible market positions, recurring revenues and premium products

Approach

Controlling equity stake (MBO / LBO) and board seats along with strong management teams

Regional Focus

We focus on the DACH-region, especially Germany, but seek global add-ons. Our offices are located in Frankfurt and Munich

Partners

The highly experienced HBL partners consistently built their successful track record in the German small / mid cap market.

Dr. Peter Hammermann

Jens Bender

Jörg Leussink

Unique Combination

cf:M

Jens Bender and Jörg Leussink founded the small- and mid-cap corporate finance advisory firm in 2012 after having worked at Bankhaus Metzler and Commerzbank for over a decade. cf:M is focused on small- and mid-cap M&A-advisory in the DACH-region.

Private Equity

To complement cf:M’s service offering and to further professionalize the investment business with family offices, HBL InvestmentPartners GmbH was founded in 2018 together with Dr. Peter Hammermann, one of the pioneers of the private equity business in German-speaking countries over the past 20 years.

HBL InvestmentPartners

In July 2018, the partners closed their first investment with the acquisition of TCT TechnikCentrum Thale GmbH. Since then, three further investments have been made.

OUR POSITION

Investment Criteria

Investments

-

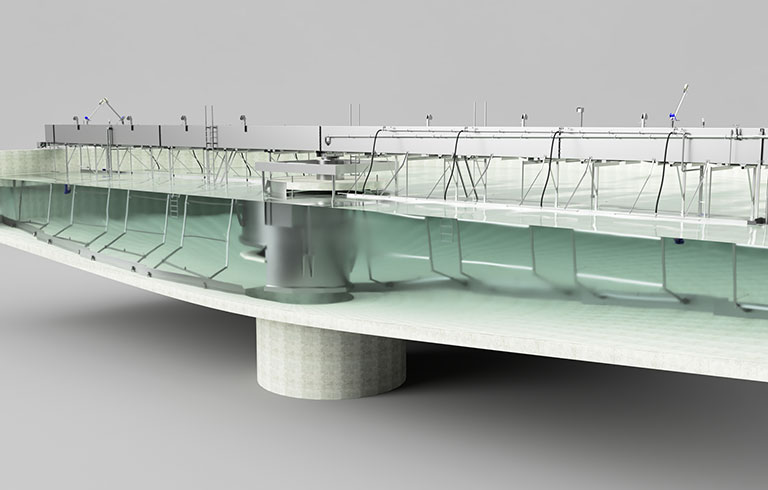

AWT Umwelttechnik GmbH

AWT Umwelttechnik GmbH

-

Zahnen Technik GmbH

Zahnen Technik GmbH

-

ZWT Wasser- und Abwassertechnik GmbH

ZWT Wasser- und Abwassertechnik GmbH

-

TCT TECHNIKCENTRUM THALE GMBH

TCT TECHNIKCENTRUM THALE GMBH